Homebuyer Demand Outpaced Supply Mid-Pandemic

Supply of homes for sale was down 24% from a year ago in April and new listings fell by 42%, but home prices were still up 5%

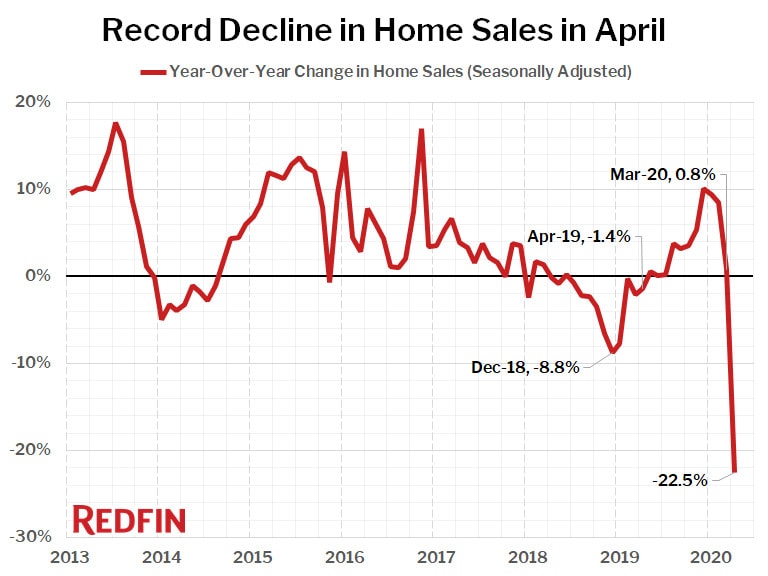

The effects of the coronavirus pandemic and subsequent shutdowns hit the housing market in full force in April, with sales and listings both turning in historic declines from year-ago levels. In the past two months, the housing market has seen the fastest slowdown on record as it flipped from one of the strongest markets ever at the end of February to a near standstill in April.

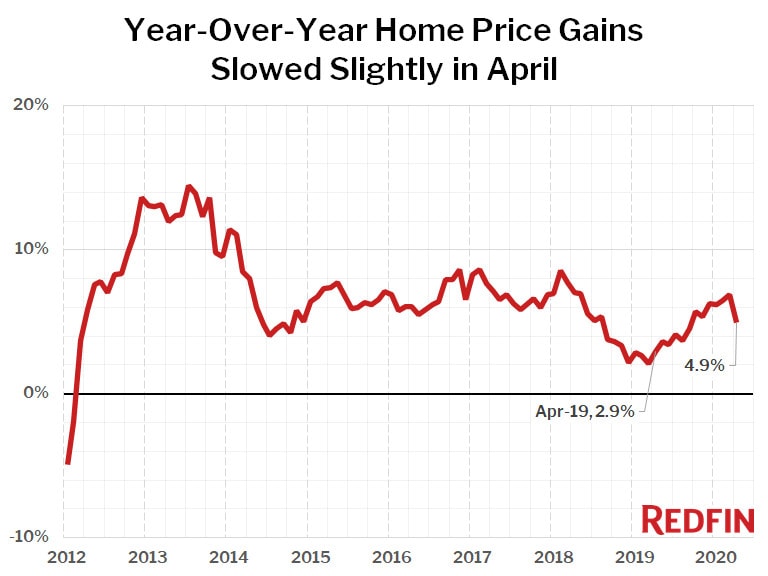

Home sales in April plunged 22.5% from a year ago, as did both the number of homes newly listed for sale (-42.4%) and the number of homes available for sale (-24.5%). Home prices were still up from a year ago, but the rate of growth in the U.S. median home sale price stumbled slightly to 4.9% year over year, down from 6.9% in March. The national median sale price in April was $303,895.

April home sales fell 23% nationwide from March on a seasonally-adjusted basis, by far the largest decline on record (our data for this statistic goes back to January 2012). In general, markets with the biggest declines in home sales from a year ago were the most expensive, although due to especially tight restrictions on real estate during the shutdown, Detroit was also one of the three markets where sales slowed the most: San Francisco (-53.9%), Detroit (-46.8%) and New York (-45.8%).

Market Summary April 2020 Month-Over-Month Year-Over-Year Median sale price $303,900 0.3% 4.9% Homes sold, seasonally-adjusted 409,100 -22.8% -22.5% New listings, seasonally-adjusted 361,800 -34.9% -42.4% All Homes for sale, seasonally-adjusted 1,662,200 -14.4% -24.5% Median days on market 35 -9 -7 Months of supply 2.88 0.35 0.05 Sold above list 27.7% 2.5 pts† 3.6 pts† Median Off-Market Redfin Estimate $296,600 0.5% 1.7% Average Sale-to-list 98.8% 0.2 pts† 0.4 pts† † – “pts” = percentage point change“The supply of homes for sale declined even more dramatically than homebuyer demand in April,” said Redfin lead economist Taylor Marr. “While home sales fell the most in more expensive markets, in more affordable areas prices continued to increase. Even during the depths of the slowdown last month the market was still faster and more competitive than it was a year earlier.”

Many of the nation’s most affordable housing markets are continuing to see sizable price gains. Nine of the top 10 metro areas where home prices rose the most year over year still had median prices below the national level, led in April by Detroit, (median price $159,900, +27.9%), Memphis ($217,000 +22.0%) and Philadelphia ($250,000, +19.0%).

Only one of the 85 largest metro areas Redfin tracks saw a year-over-year decline in the median sale price: San Francisco at -0.2%.

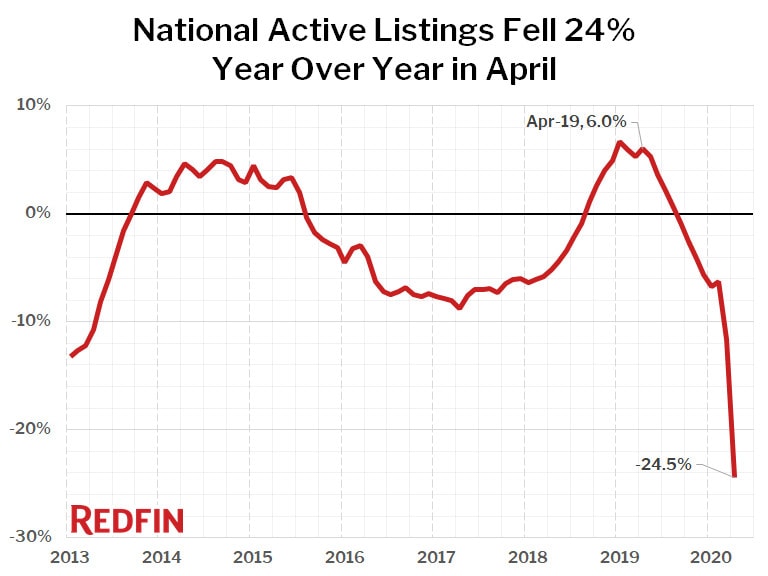

The national count of active listings of homes for sale fell 24.5% year over year during April, the biggest drop on record and the eighth straight month of declines. There were fewer homes for sale last month than any time since at least January 2012, which is as far back as we have recorded this measure. None of the 85 largest metros tracked by Redfin posted a year-over-year increase in the count of seasonally-adjusted active listings of homes for sale. The smallest declines were in Greenville, SC (-7.6%), El Paso (-8.0%) and Omaha (-10.2%). Active listings is a count of all homes that were for sale at any time during the month.

Compared to a year ago, the biggest declines in active housing supply in April were in Allentown, PA (-55.4%), Kansas City, MO (-48.8%) and Tulsa (-48.5%).

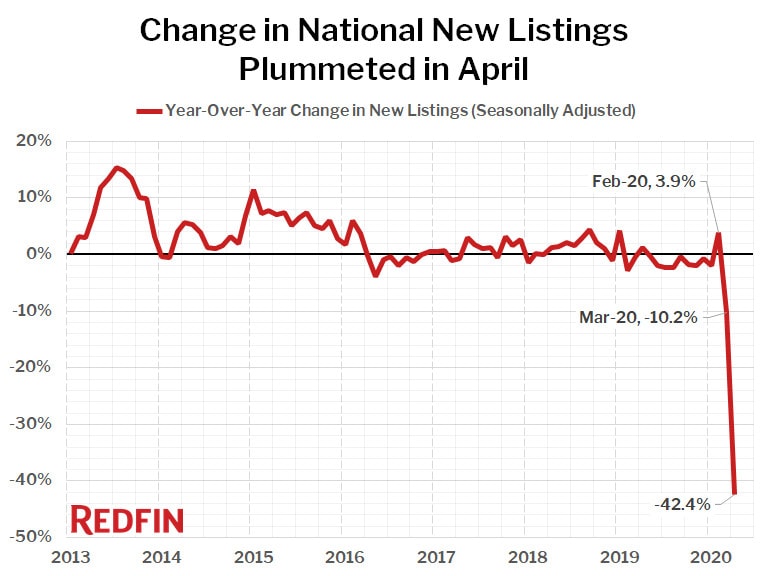

The number of new listings continued to plunge in April, falling 42.4% compared with a year earlier and down 34.9% from March. This dwarfs all other declines on record, although by the end of the month we did start to see listings begin to rebound.

So far the pandemic has only slightly slowed the rapid gains we had been seeing earlier in the year in the sales prices of homes. The median price of homes that sold in April was up 4.9% from a year earlier, slightly less than the previous four months, which all saw gains over 6%. However, even that dip was likely mostly caused by a decline in the number of high-end homes that are selling during this crisis relative to other price ranges.

“The typical time between when a home went under contract and when the sale closes is still about four weeks nationally,” explained Marr. “This means that many of the homes sold in April went under contract after the WHO declared that COVID-19 was a global pandemic, after initial claims for unemployment set new records, and after case numbers were already growing rapidly in the U.S. So, although some might have expected this dramatic disruption in the market to impact home prices, we haven’t yet seen evidence that it has had much of an effect.”

One thing that may be helping to prop up prices is low mortgage rates, which were as low as 3.29% during the first week of March when many offers were made on homes that sold in April. This was 1.12 percentage points lower than the same week of 2019, a monthly savings of $156 on the mortgage payment of the median-priced home.

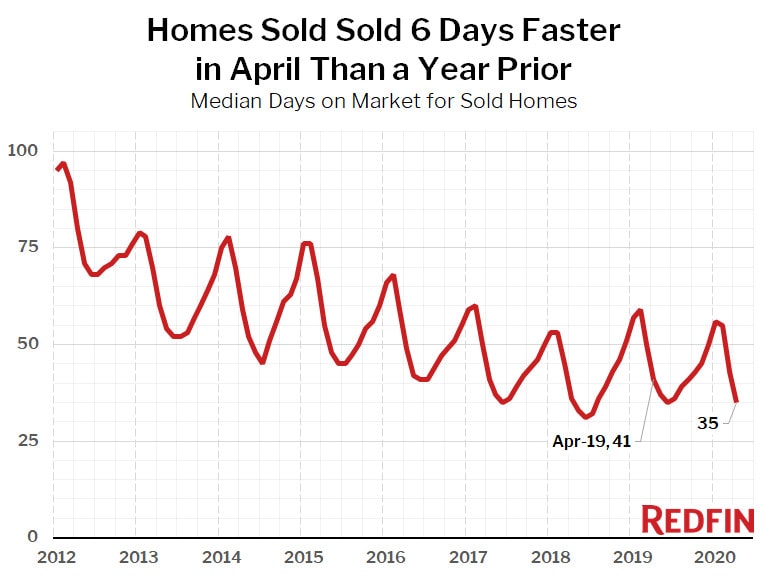

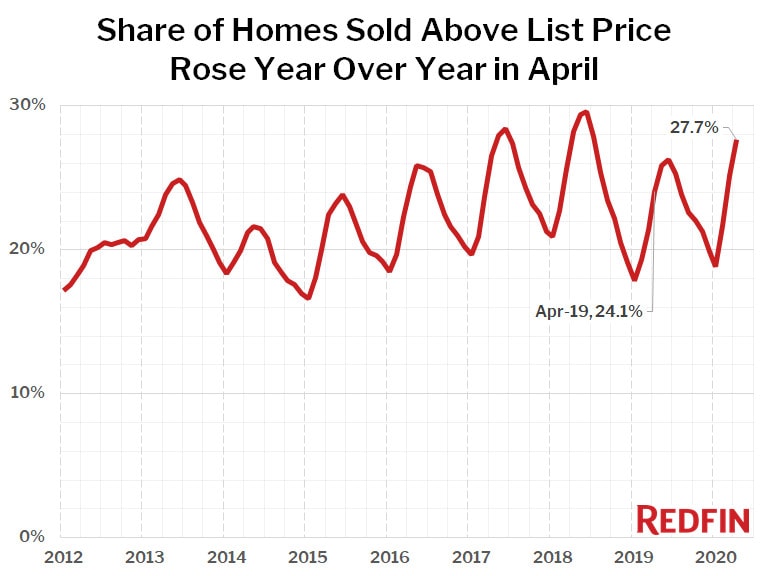

Other measures of the market showed how competitive it was in April, despite lockdowns across the nation. Homes sold faster and a greater share sold for over list price than a year ago, clearly indicating that it is still a seller’s market.

Homes that sold in April spent six fewer days on market compared to the prior year. In April, the typical home went under contract in 35 days, compared to 41 days in April 2019.

The share of homes that sold above list price increased 3.6 percentage points year over year, coming in at 27.7% in April compared to 24.1% a year earlier.